|

This article is intended to contrast a serious oil supply problem in the first decade of the 2000s and contrast it with the need to quickly reduce emissions from the use of oil, gas, and coal. The supply issue was predicted quite accurately back in 1956 and was dubbed Peak Oil, after which alternate fuels would be needed to maintain our lifestyle. In the 1980s through to today, we have been agonizing over climate change caused by our use of fossil fuels. The response to Peak Oil could have subdued climate change but no one acted soon enough. Now is the time to get our individual and collective acts together to soften the blows to come.

New countries were born, borders were moved, wars were fought (and are still being fought), to accommodate or protect oil production. Major international oil conglomerates exploited these tremendous, apparently limitless, resources. National oil companies took back "their" resources in many places, but relied on the multi-nationals for technical expertise and markets. The details would be too boring for words. What is

interesting, and pertinent, is the state of oil today, a mere 150

years after Williams’ discovery. The exponential rise in use of oil

over the past 50 years has placed civilization on a slippery slope

of climate change, declining production capacity

in the face of sky-rocketing energy demand We are

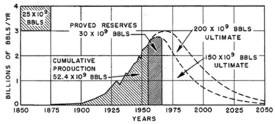

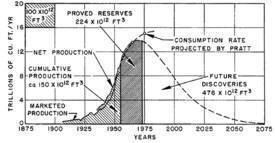

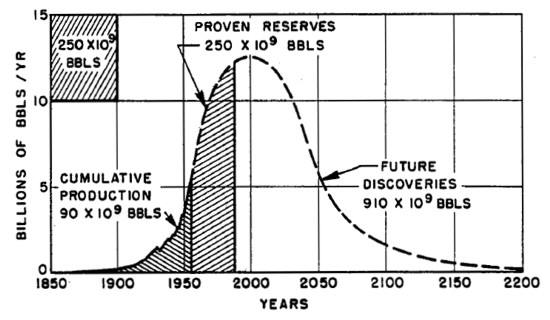

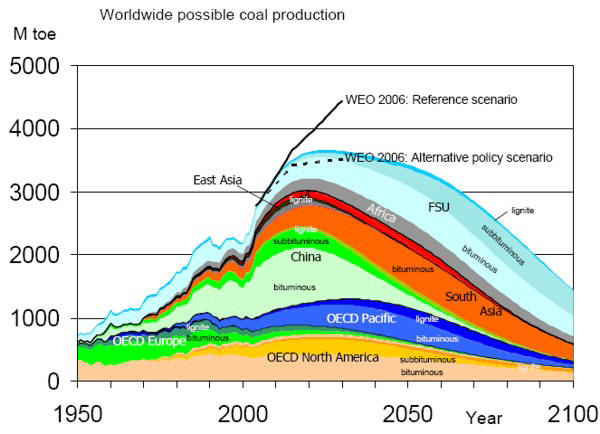

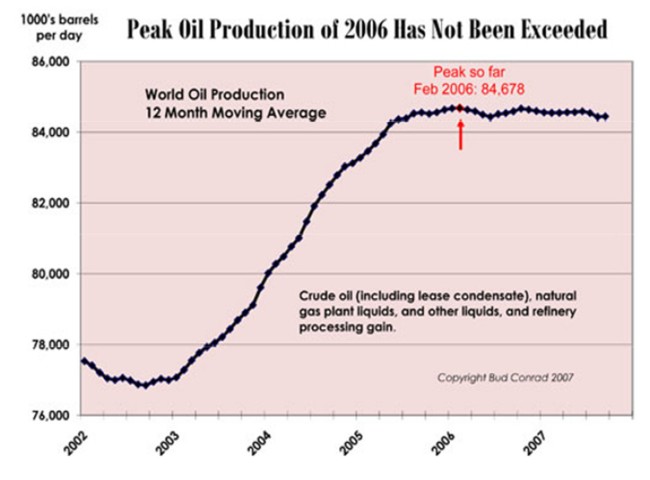

nearing or just past "Peak Oil". We'll know for sure very soon. Hubbert’s thesis was that the world’s proven discoveries, plus new discoveries postulated from previous experience, would be produced at a rate that followed a Gaussian distribution (bell curve). The shape of the curve was set to fit annual production rates to date. The area under the curve would equal the sum of production-to-date plus remaining reserves, plus reserves yet to be discovered. The peak date could then be predicted by observation of the graph. He demonstrated that his concept was true for several depleted basins in the USA, then extended the concept to the entire USA, then to the whole world (as known to Shell, his employer, at the time).

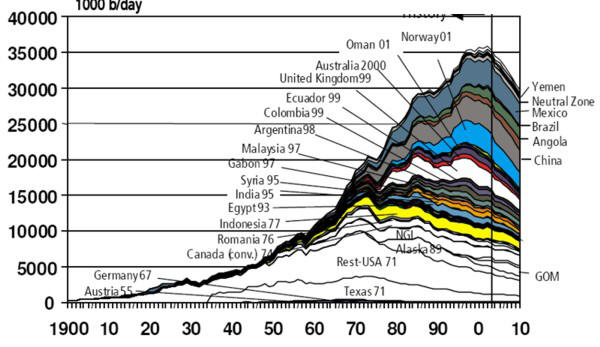

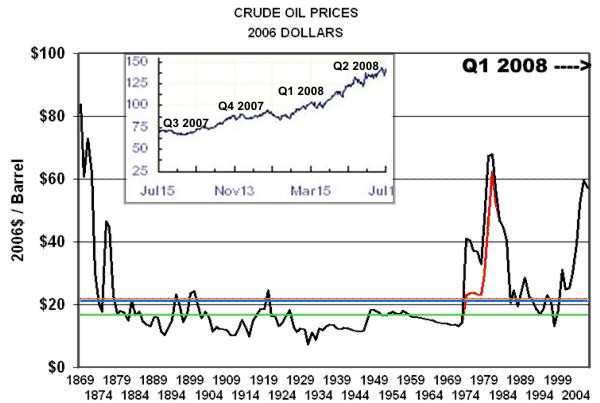

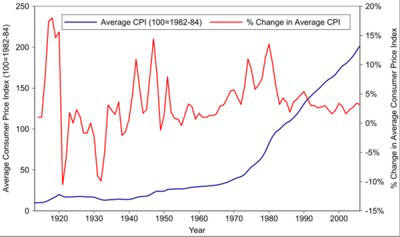

The record for the last 100+ years’ production has been plotted by a major supplier in the image below, showing peak oil rate occurring around the year 2000. The flat top may indicate that so-called “swing producers” such as Saudi Arabia may not be able to produce more than they currently do to supply latent demand. This would explain the rapid rise in oil price starting in 2002. Although Hubbert’s paper spends 47 of its 57 pages discussing peak oil, peak gas, and peak coal, the purpose of the paper was to demonstrate the need to develop nuclear power to offset future declines in fossil fuel availability. That need has not disappeared, but we are 65+ years further along the slippery slope than Hubbert was. No major oil company has yet integrated horizontally to include nuclear, wind, or solar technology to augment their depleting reserve base, not even Shell, which had paid Hubbert for his research. Hubbert’s professional reputation was seriously harmed by this presentation. Most professionals of the era thought oil was virtually inexhaustible. Today, most of the world’s 7.5 billion people either feel this way too, or have never thought about the problem at all. Price and production rate are highly linked, of course, and production quota limits set by OPEC tend to distort near-term trends. But the historical data is pretty revealing. The cost of living (price index) and rate of inflation are strongly related to oil price and production rates, because everything we buy (from food to housing to clothing) has an energy component in manufacturing, delivery, or use.

Compare

the red curve to the oil price curve shown above. Substitution, alternate renewable energy sources, conservation, and

moral choice may reduce the impact of the Peak Oil problem, which

has not yet appeared on the image at the right, which ends in 2003.

The Second Paradox is Society’s unwillingness to face up to its responsibility to future generations. NIMBY rears its ugly head for most alternate energy sources. This is highly irrational. Dangers from the automobile far outweigh dangers from nuclear accidents or bird deaths from wind turbines. Automobiles and trucks kill 10 million birds a year in the USA, wind turbines only 70,000. Esthetic objections border on the insane – just look at urban sprawl or the downtown core of many cities if you want to see ugly. Traffic accidents take 45,000 and firearms take 30,000 lives each year in the USA alone. These CDC stats don’t count deaths from auto or coal pollution or industrial accidents at mines, drilling rigs or refineries (or the “oil wars” in Kuwait, Iraq, Sudan...). Multiply by 50 or 100 to estimate energy related deaths for the world. By comparison, nuclear looks pretty safe at about 4000 deaths total across more than 50 years, all associated with Chernobyl in 1986, which was a primitive, inherently unsafe design. There were no deaths at Windscale (UK, 1957) or Three Mile Island (USA, 1979), the only other civilian reactor failures. A grand total of 4 deaths have been reported at military research reactors in the USA due to nuclear accidents. The Third Paradox is irrational Government and Industry response to “junk” science. For example, there is no “hydrogen economy”. There is no natural source of hydrogen – it has to be manufactured using other forms of energy. The energy Output to Input ratio is 0.7, so the process is always below its economic limit. There is no Free Lunch or Perpetual Motion Machine. Bio-fuels from crops are merely breakeven on energy inputs. Soil degradation of mono-culture and land diversion from food crops are negative factors. Bio-waste appears to be economic inside the plant gate, but trucking in and out has not been counted. The

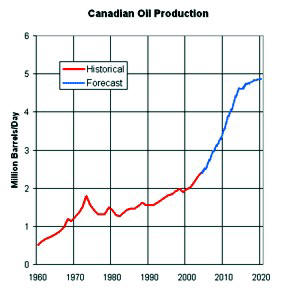

Fourth Paradox is Canada’s continued increase in oil output which tends to divert attention locally away from Peak Oil.

Canada's conventional oil production peaked in 1974, but tar sands

production has reversed the decline. Current capacity in the tar

sands has brought Canadian production to more than 4.7 million

barrels per day (2019), equal

to Iran, and double Venezuela or Iraq. Canada's steady increase in production contrasts markedly with production declines in nearly every other major oil-producing country. For example, before and after the 1st Gulf War in 1991, Kuwait’s Greater Burgan Field produced 2 million barrels per day, but cannot get past 1.4 million today. Most giant fields of the Middle East and Russia are in the same boat, according to investment banker Matthew Simmons with current decline rates between 5 and 10% per year. Simmons recent (Feb 2008) presentation to the US Pentagon was pretty scary. If the Pentagon understood him, it might get scarier still. The majority of Canadian production is exported to the United States by pipeline. Canada is the largest single supplier of US oil needs, a fact not well appreciated by US citizens or the rest of the world. “Offset” oil from the Middle East is imported into Eastern Canada – this paradox may need some re-thinking in the near future. Aside from the oil sands, another significant reason for increased production in Canada is that independent oil companies, operating under a favourable free-enterprise tax system and rule of law, are content to produce from thin, low productivity, low quality reservoirs. The risk of political upheaval or confiscation is very low, as is exploration and development risk. Policies, politics, and egos (not economics) make production from poor quality reservoirs difficult in most other regimes, except in the continental US and Western Europe on-shore. There is no magic bullet to cure the world's addiction to oil, so the exploitation of lower quality reservoirs will have to become "standard operating practice" very soon in the rest of the world. Put 500

Canadian independents into Saudi or Venezuela, with Canadian rules

and royalties, and the production rates would double in no time! When the peak will occur is open to considerable debate. Princeton Professor of Geology Kenneth Deffeyes (reference 3) thinks it happened in December 2005. Matthew Simmons thinks it happened in 2007.

You can’t actually fix Peak Oil. It’s going to happen. But, like software bugs, there are work-arounds. Let’s assume Plan A is to do nothing and fritter away our dwindling heritage of easy energy. I have two tame squirrels who can do better than that – they store nuts even though an inexhaustible supply is on the feeder every day. Business leaders, with or without the help of political leaders, have to come to grips with the Peak Oil issue immediately and establish plans whereby renewable energy can be built and installed, using oil and gas as needed, before this option runs out or becomes too expensive to be effective. Some may be doing this now, but they have been diligent in hiding the fact. So Plan B might be to think beyond the short-term of share-price and move on to longer term planning, using some of the windfall from $100 oil to grease the skids. Every option can be considered, including clean-coal, nuclear, wind, solar, waves, tides…. It’s called “thinking outside the box” or “widening the envelope”.

By diverting oil and gas from electric generation (replacing it by alternate sources), the available hydrocarbon reserves will allow personal transportation to survive a little longer. Without hydrocarbon diversion and replacement by renewables, the automobile and airplane are a fast-dying breed.

|

||

|

Page Views ---- Since 01 Jan 2015

Copyright 2023 by Accessible Petrophysics Ltd. CPH Logo, "CPH", "CPH Gold Member", "CPH Platinum Member", "Crain's Rules", "Meta/Log", "Computer-Ready-Math", "Petro/Fusion Scripts" are Trademarks of the Author |

||

|

||

| Site Navigation | FUTURE OF OIL and GAS PEAK OIL and CLIMATE | Quick Links |

Price

Index (blue) and Inflation Rate (red) for comparison to oil price

changes ==> .

Price

Index (blue) and Inflation Rate (red) for comparison to oil price

changes ==> .

<== Increasing Canadian oil production is due to oil sand production

and is expected to reach 5 million barrels per day by 2020.

<== Increasing Canadian oil production is due to oil sand production

and is expected to reach 5 million barrels per day by 2020.

Who

is better qualified to do this than existing oil and gas companies?

We have conquered the frigid Arctic, deep oceans, and super-hot

geothermal terrains. How tough can a wind farm or nuclear reactor

be? Or would you prefer a Dot-Com startup to do it for you?

Who

is better qualified to do this than existing oil and gas companies?

We have conquered the frigid Arctic, deep oceans, and super-hot

geothermal terrains. How tough can a wind farm or nuclear reactor

be? Or would you prefer a Dot-Com startup to do it for you?